Table of Contents

ToggleKeeping Your Head Above Water in the World of Sports Trading

Let’s talk about something crucial in sports trading: managing risk. It’s not the most glamorous topic, sure, but it’s absolutely vital if you want to stay in the game long-term. Think of it as the foundation of your trading house: without it, everything else can come crashing down.

It is something that must be considered essential.

Staying Smart with Your Stakes

The first area of focus has to be your staking plan. This is where so many traders, even experienced ones, can slip up. It’s tempting to go big when you’re feeling confident, or to chase losses with even bigger bets. That’s a recipe for disaster, it truly is. What you need is a consistent, disciplined approach.

The key here is to think in percentages, not absolute monetary values. A common recommendation is to risk only a small percentage of your total bankroll on any single trade, something like 1-2%. That’s work for everyone.

Why so low? Because it protects you from the inevitable ups and downs of trading. Even the best traders have losing streaks. A small percentage-based stake ensures that a few bad trades won’t wipe you out. It’s all about preserving your capital so you can keep making trades. There are other approaches, each with its own pros and cons. It’s about finding what clicks with your trading style and risk tolerance.

One alternative is the “Fixed Unit” approach. Instead of a percentage, you decide on a fixed monetary amount for each trade. For example, you might decide that your standard “unit” is $50. This makes it easy to track your profits and losses in terms of units. The downside, of course, is that it doesn’t automatically adjust as your bankroll grows or shrinks. You’ll need to manually adjust your unit size periodically, based on your performance. The key is how you define your unit.

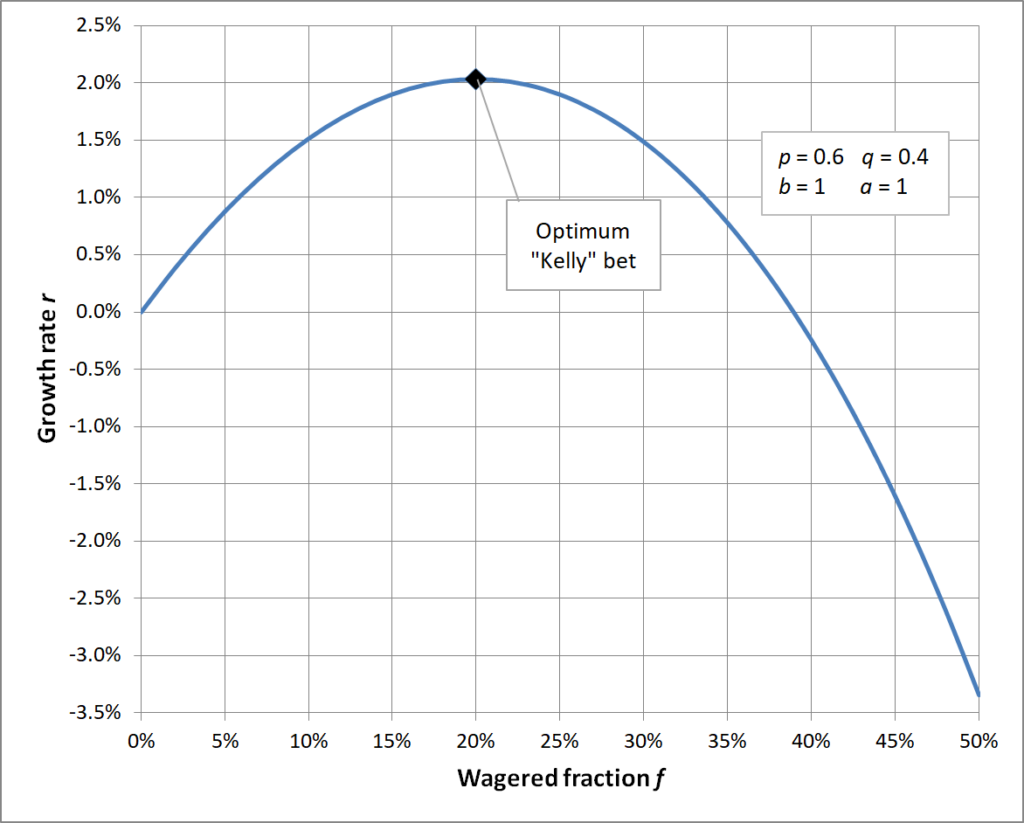

Then there’s the “Kelly Criterion”, which is a bit more mathematically complex. It’s a formula designed to optimize your bet size based on the probability of winning and the odds you’re getting. The full Kelly Criterion often suggests quite aggressive stakes, so many traders use a “fractional Kelly” approach – say, half Kelly or quarter Kelly – to reduce the risk. This method is more dynamic than fixed percentage or fixed unit staking, but it requires you to accurately estimate your win probability, which can be tricky. Honestly, it can get complicated.

Another strategy, often used in conjunction with other methods, is “Variable Staking” based on your confidence level. This means you might risk 2% on a trade you feel very confident about, but only 0.5% on a trade where you’re less certain. This adds a subjective element, and it’s crucial to be honest with yourself about your confidence levels. Don’t let overconfidence lead you to overstake. It is very easy to be overconfident.

You might also encounter “Progressive Staking” systems, like the Martingale or Fibonacci sequences. These involve increasing your stake after a loss (Martingale) or following a specific sequence of increases and decreases (Fibonacci). These systems can be very dangerous, as a losing streak can quickly lead to massive stakes and potentially wipe out your bankroll. They’re generally not recommended for beginners, and even experienced traders should use them with extreme caution, if at all. They sound nice on paper.

The key takeaway here is that there’s no one-size-fits-all answer. The best staking plan is the one that you can stick to consistently, that protects your capital, and that aligns with your trading style and risk tolerance. Experiment, keep good records, and be willing to adjust as you learn and grow as a trader. It’s a continuous process of refinement. Don’t be afraid to try diffrent things.

Take the time to find the right one. Sticking to this plan, regardless of how tempting it might be to deviate, is crucial. This isn’t just about setting rules; it’s about developing the mental fortitude to follow them.

The Psychology of Loss Aversion

Now, let’s get into the mental side of things, because trading is as much a mental game as it is a numbers game. One of the biggest hurdles traders face is “loss aversion.” It is a real thing. This is the tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain. Makes sense, right? Nobody likes losing. But in trading, this can lead to some really bad decisions. It has to do with psychology.

Loss aversion can manifest in a few ways. You might hold onto a losing trade for too long, hoping it will turn around, rather than cutting your losses and moving on. Or, you might be tempted to increase your stake after a loss to try and win back what you’ve lost quickly – the dreaded “revenge trading.”

Both of these are driven by emotion, not by sound trading principles. Learning to recognize and manage loss aversion is absolutely essential. It means acknowledging that losses are part of the process and sticking to your pre-defined exit strategy, regardless of how you feel in the moment.

Embracing the Long Game

Finally, let’s talk about the importance of a long-term perspective. Sports trading isn’t a get-rich-quick scheme. It’s a marathon, not a sprint. There will be good periods and bad periods. The key is to focus on making consistently good decisions, based on your trading strategy and your risk management plan, rather than getting caught up in short-term results.

One thing that can really help is keeping a detailed trading journal. Note down every trade you make, the rationale behind it, the outcome, and any lessons learned. This isn’t just busywork. It allows you to track your performance over time, identify patterns, and refine your strategy.

It also helps you stay accountable to yourself and your plan. Remember, the goal isn’t to win every trade. It’s to be profitable overall, over the long haul. And that requires patience, discipline, and a solid understanding of risk. It is about small gains, repeated.